#Venmo Weekly Limit

Explore tagged Tumblr posts

Text

The Ultimate Guide to Using Venmo: Tips, Limits, and Integrations

Venmo has become an essential tool for managing personal finances, offering a seamless way to what is plaid venmo transfer money, pay for services, and interact socially through payments. This detailed guide will cover various aspects of Venmo, from integration with Apple Pay to understanding limits, and more. Let's dive into these important topics.

Venmo to Apple Pay

While Venmo and Apple Pay are distinct payment systems, you can use your Venmo card with Apple Pay for added convenience. Here's how to add your Venmo card to Apple Pay:

Open the Apple Wallet App: On your iPhone, open the Wallet app.

Add Card: Tap the "+" sign to add a new card.

Enter Venmo Card Details: Either scan your Venmo card or manually enter the card information.

Verify: Follow the on-screen instructions to verify your card with Venmo.

Once added, you can use your Venmo card through Apple Pay for purchases wherever Apple Pay is accepted.

Venmo Weekly Limit

Venmo has set transaction limits to ensure the safety and security of its users. Here are the limits:

Unverified Accounts: The weekly sending limit is $299.99.

Verified Accounts: The weekly sending limit is $4,999.99 for person-to-person payments, with an additional $2,999.99 for authorized merchant payments, making a total of $6,999.99.

To increase your limits, you need to verify your identity by providing personal information such as your Social Security number and date of birth.

Venmo Login

Logging into Venmo is simple and straightforward. Here’s how you can log in:

Visit www.venmo.com: Open your web browser and go to Venmo’s website.

Enter Your Credentials: Input your email or phone number and password.

Two-Factor Authentication: Complete any additional security steps, such as entering a verification code sent to your phone.

Alternatively, you can log in via the Venmo app:

Open the Venmo App: Available on both iOS and Android platforms.

Enter Your Credentials: Input your email or phone number and password.

Two-Factor Authentication: Complete any additional security steps.

What is Plaid Venmo?

Plaid is a what is the limit on venmo financial technology company that Venmo uses to securely link your bank accounts. Plaid allows Venmo to access and verify your bank account information quickly and securely, ensuring a smooth and secure transfer of funds. This integration helps Venmo users link their bank accounts without needing to enter account and routing numbers manually.

What is the Limit on Venmo?

The limits on Venmo transactions depend on whether your account is verified:

Unverified Accounts: $299.99 per week.

Verified Accounts: $4,999.99 per week for person-to-person payments and an additional $2,999.99 for authorized merchant payments, totaling $6,999.99 per week.

Why Did Amazon Drop Venmo?

Amazon's decision to drop Venmo as a payment option was influenced by strategic business decisions and existing partnerships with other payment processors. Amazon aims to streamline its payment processes and maintain control over transaction data, which may not align with Venmo's third-party services.

www.venmo.com

The official website for Venmo, www.venmo.com, is your go-to resource for managing your account, making payments, and accessing customer support. From this site, you can log in to your account, review transaction history, and find answers to frequently asked questions.

Add Venmo to Apple Pay

You can add your Venmo card to Apple Pay to make purchases using your Venmo balance. Follow these steps:

Open the Apple Wallet App: On your iPhone, open the Wallet app.

Add Card: Tap the "+" sign to add a new card.

Enter Venmo Card Details: Either scan your Venmo card or manually enter the card information.

Verify: Follow the on-screen instructions to verify your card with Venmo.

Can You Use a Credit Card on Venmo?

Yes, you can use a credit card on Venmo to send money. However, keep in mind that using a credit card for Venmo transactions incurs a 3% fee. To add a credit card:

Open the Venmo App: Log in to your account.

Go to Settings: Tap on the menu icon (☰) and select "Payment Methods."

Add Card: Select "Add a Bank or Card" and choose "Card."

Enter Credit Card Information: Input your card details and tap "Add."

Can You Use Venmo with a Credit Card?

Yes, you can use Venmo with a credit card. This option is available for making payments and funding transactions. Just be aware of the 3% fee associated with credit card transactions on Venmo.

Cash App to Venmo

Transferring money directly from the Cash App to Venmo isn't possible. However, you can use a linked bank account to transfer funds between these platforms:

Transfer from Cash App to Bank: Move the desired amount from your Cash App balance to your linked bank account.

Transfer from Bank to Venmo: Once the funds are in your bank account, transfer them to your Venmo balance.

Contact Venmo Customer Service

If you need help with your Venmo account, you can contact customer service through several methods:

Phone: Call Venmo's customer service at their official telephone number, available on the Venmo website.

Email: Send an email to Venmo support via the contact form on their website.

In-App Chat: Use the chat feature in the Venmo app to get real-time assistance.

Conclusion

Venmo is a versatile and convenient platform for managing your personal finances. From understanding transaction limits and integrating with Apple Pay to what is the venmo limit knowing how to contact customer service, this guide provides all the information you need to use Venmo effectively. Stay informed and make the most of your Venmo experience!

#what is the venmo limit#venmo to apple pay#venmo weekly limit#venmo.login#what is plaid venmo#what is the limit on venmo

0 notes

Text

How to increase the transfer limit on Venmo?

Venmo has become a popular choice for peer-to-peer payments, offering a simple and efficient way to transfer money, split bills, and make purchases. However, users often encounter transaction limits that can restrict the amount of money they can send, spend, or transfer. If you're wondering how to increase Venmo limit, you're not alone. This guide will provide detailed insights into the process and offer practical steps to help you maximise your Venmo account's potential.

What is the Venmo Weekly Limit?

The Venmo weekly limit refers to the maximum amount of money you can send or spend within seven days. This limit is crucial for preventing fraud and ensuring the security of transactions.

Unverified Accounts

For unverified accounts, the limits are relatively low:

Sending Limit: Up to $299.99 per week.

Purchasing Limit: Up to $299.99 per week.

Transfer Limit: Varies, but generally lower than verified accounts.

Verified Accounts

Once you verify your account, the limits increase substantially:

Sending Limit: Up to $4,999.99 per week.

Purchasing Limit: Up to $4,999.99 per week.

Transfer Limit: Up to $19,999.99 per week (individual transfers capped at $2,999.99).

How to Increase Venmo Limit?

Increasing your Venmo limit involves verifying your identity and providing additional information to Venmo. Here’s a step-by-step guide:

Open Venmo App: Launch the Venmo app on your mobile device.

Access Settings: Tap on the menu icon (three horizontal lines) in the upper-left corner.

Tap on 'Settings': Navigate to the settings menu.

Select 'Identity Verification': Choose the identity verification option.

Enter Personal Information: Provide your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Submit Verification: Follow the prompts to complete the verification process.

Frequently Asked Questions (FAQs)

What is Venmo's weekly limit?

For verified accounts, the Venmo weekly limit is $4,999.99 for payments and purchases. For unverified accounts, the limit is $299.99 per week.

What is the Venmo limit per day?

Venmo does not specify a daily limit, but it operates within the context of the weekly limits. Daily transactions should be within the weekly limits set by Venmo.

When does Venmo's weekly limit reset?

Venmo’s weekly limit resets seven days from the date of your last transaction. For example, if you made a payment on Monday, the limit will reset the following Monday.

What is the transfer limit on Venmo?

For verified accounts, the bank transfer limit is up to $19,999.99 per week, with individual transfers capped at $2,999.99. The limits are generally lower for unverified accounts.

How to increase Venmo's weekly limit?

To increase Venmo weekly limit, verify your identity by providing your full name, date of birth, and the last four digits of your SSN. Additionally, link a bank account to your Venmo account.

Can I increase my Venmo limit?

Yes, you can increase Venmo limit by verifying your identity and linking a bank account. For higher limits, you may need to contact Venmo support and provide additional documentation.

0 notes

Text

How to Increase Your Weekly Limit on Venmo ?

In today's digital age, Venmo has become synonymous with convenient and effortless peer-to-peer payments. Whether you're splitting dinner with friends or paying rent to your roommate, Venmo offers a seamless way to transfer money with just a few taps on your phone. However, like any financial service, Venmo imposes certain limits on the amount of money you can send and receive. If you find yourself bumping up against your Venmo weekly limit, don't worry – there are steps you can take to increase it. In this detailed guide, we'll walk you through the process of increasing your Venmo limit step-by-step, so you can continue to use the app without restrictions.

Venmo imposes restrictions on the amount of money you can send and receive within a rolling seven-day period. This is known as your Venmo weekly limit. While the specific limit may vary depending on factors such as account verification and transaction history, it's essential to be aware of your current limit to avoid any inconvenience when making transactions.

How to Increase Your Venmo Weekly Limit:

Now, let's explore the steps you can take to elevate your Venmo weekly limit and enjoy greater flexibility in your transactions:

Verify Your Identity:

One of the most effective ways to increase Venmo limit is to verify your identity within the app. To do this, navigate to the settings menu in your Venmo app and select "Identity Verification." Follow the prompts to provide the required information, such as your full name, date of birth, and Social Security number. Once your identity is verified, Venmo may automatically increase your weekly limit.

Link a Bank Account:

Linking a bank account to your Venmo account can also help increase your weekly limit. To add a bank account, go to the settings menu and select "Bank Accounts." Follow the instructions to link your account securely. Venmo may view users who have linked bank accounts as more trustworthy and may be more inclined to raise their limits.

Build a Positive Transaction History:

Consistent and responsible use of Venmo can contribute to an increase in your weekly limit over time. Make regular transactions within your current limit and avoid any suspicious or high-risk activities. By demonstrating a positive transaction history, you show Venmo that you are a reliable user deserving of a higher limit.

Contact Venmo Support:

If you've taken the above steps and still find your weekly limit insufficient, you can reach out to Venmo's customer support for assistance. Explain your situation and request a limit increase, providing any relevant documentation or information they may require. Venmo's support team will review your request and respond accordingly.

Summary:

Increasing your Venmo weekly limits can provide you with greater flexibility and convenience when sending and receiving money. By following the steps outlined in this guide and working closely with Venmo, you can elevate your weekly limit and enjoy seamless peer-to-peer payments. Remember to stay informed about your account settings and transaction history to ensure a safe and secure experience with Venmo.

Common Queries on Venmo limit

Q: What is the Venmo weekly limit?

A: The weekly limit Venmo refers to the maximum amount of money you can send and receive within a rolling seven-day period. This limit is determined by factors such as account verification and transaction history.

Q: How do I increase my Venmo weekly limit?

A: To increase your Venmo weekly limit, you can verify your identity within the app, link a bank account, build a positive transaction history, and contact Venmo support for assistance.

Q: When does the Venmo weekly limit reset?

A: The Venmo weekly limit resets on a rolling basis, meaning that the seven-day period starts from the time of your last transaction. You can track the reset time within the Venmo app to ensure you're aware of when your limit refreshes.

#venmo weekly limit#weekly limit venmo#venmo weekly limits#venmo weekly spending limit#venmo weekly limit reset#what is venmo weekly limit#what is venmo limit per day#weekly limit on venmo#when does venmo weekly limit reset#venmo weekly transfer limit#what is the transfer limit on venmo#daily limit venmo#what is venmo weekly sending limit#how to increase venmo weekly limit#increase venmo limit#how to increase venmo limit#how to increase weekly limit on venmo

0 notes

Text

What Is Maximum Venmo Person To Person Limit: Daily, Weekly, & Monthly Transaction Limit

In the ever-evolving world of digital finance, Venmo has emerged as a trailblazer, making peer-to-peer transactions simpler and more convenient than ever before. It's no surprise that individuals are flocking to this platform to send and receive money. However, with this surge in popularity, it's essential to understand the limitations and boundaries that Venmo imposes to ensure a seamless financial experience. In this comprehensive guide, we will delve into the intricacies of Venmo Person To Person Limit (Venmo transaction limits), covering daily, weekly, and monthly restrictions, and help you navigate the world of digital payments with confidence.

Daily Transaction Limit

Venmo, like any responsible financial service, sets a daily transaction limit to safeguard its users from potential fraud or misuse. As of the latest update, Venmo's daily transaction limit for person-to-person payments stands at $6,999.99. This means that within 24 hours, you can send or receive up to this amount. It's important to note that this limit applies to both sending and receiving funds combined. Exceeding this daily limit will result in your transactions being declined until the limit resets.

Weekly Transaction Limit

Moving beyond the daily cap, Venmo also imposes a weekly transaction limit. This limit is designed to ensure the security of your financial activities and protect your account from unauthorized access. Currently, the weekly transaction limit on Venmo for person-to-person payments is $19,999.99. This cap extends from Monday at 12:00 AM to the following Sunday at 11:59 PM, local time. It's crucial to keep track of your transactions throughout the week to avoid any disruptions in your payment activities.

Monthly Transaction Limit

In addition to the daily and weekly limits, Venmo has a monthly transaction limit in place. This cap is a more substantial boundary, ensuring that your financial activities remain secure throughout the month. As of the latest information available, the monthly transaction limit for person-to-person payments on Venmo is Up to $60,000 if You complete Venmo Identity Verification, The maximum amount per transfer is $5,000. This limit encompasses the entire calendar month and resets on the first day of each month. Be mindful of your transaction volume, as exceeding this monthly limit can result in temporary restrictions on your Venmo account.

How To Increase Venmo Limit?

To increase your Venmo limit, you'll need to verify your identity and provide additional information to the platform. Venmo, like many other financial services, imposes limits on account activity to comply with regulations and ensure security. Here's how you can increase your Venmo limit:

Complete Your Profile: Make sure your Venmo profile is complete with accurate information, including your legal name, date of birth, and phone number.

Verify Your Phone Number: Ensure that your phone number is verified in the Venmo app. You should have access to the phone number you're using, as Venmo may send you verification codes via SMS.

Link Your Bank Account: Linking your bank account to Venmo is essential. This helps Venmo verify your identity and allows you to transfer money to and from your bank account. To do this:a. Open the Venmo app. b. Tap on the "☰" icon in the upper left corner. c. Tap on "Settings." d. Select "Payment Methods." e. Tap on "Add Bank or Card" and follow the prompts to link your bank account.

Verify Your Identity: Venmo may ask you to verify your identity further by providing additional information, such as your Social Security number or a photo of your government-issued ID. You may be prompted to do this if you reach certain transaction or balance thresholds.

Increase Usage: Gradually increasing your usage on Venmo can also help increase your limits. Regular, responsible activity on your account can demonstrate to Venmo that you are a trustworthy user.

Contact Venmo Support: If you've completed the above steps and still need to increase your limits, you can reach out to Venmo's customer support for further assistance. They can guide you through the process and may request additional documentation to verify your identity.

Keep in mind that Venmo's specific policies and procedures may change over time, so it's a good idea to refer to Venmo's official website or contact their support for the most up-to-date information on increasing your limits. Additionally, be cautious about sharing personal information and only provide it to Venmo through their official channels to protect your security and privacy.

Conclusion

In the world of digital finance, understanding the limitations of the platforms you use is crucial. Venmo, with its daily, weekly, and monthly transaction limits, offers a secure and user-friendly environment for peer-to-peer payments. While these limitations may seem restrictive at first glance, they are essential in safeguarding your financial interests. To make the most of your Venmo experience, stay within these boundaries, and if needed, explore the option to increase your limits through identity verification. By doing so, you can continue to enjoy the convenience and simplicity of Venmo for all your person-to-person payment needs.

#Venmo Person To Person Limit#Venmo Limit#Venmo Limits#Increase Venmo Limit#How To Increase Venmo Limit#Venmo Limit Per Day#Venmo Daily Limit#Venmo Weekly Limit#Venmo monthly limit

1 note

·

View note

Text

Beginner Tips for Navigating Venmo’s Weekly Sending Limit

Venmo has revolutionized the way we send and receive money. However, understanding the platform’s limitations, especially the Venmo weekly sending limit, is essential to ensure smooth transactions. In this guide, we’ll break down the key details of the sending limits, provide tips for managing them, and address common questions like "How do I know my Venmo limit?"

What Is the Venmo Weekly Sending Limit?

The Venmo weekly limit per month is a rolling cap that determines how much you can send to others via the platform. For verified accounts, the Venmo person-to-person limit is set at $4,999.99. Unverified accounts face a significantly lower limit of $299.99 per week. These restrictions are designed to safeguard users and prevent misuse.

How to Check Your Venmo Limit

One of the most frequently asked questions is, "How do I know my Venmo limit?" Here’s how to find out:

Open the Venmo app.

Navigate to the "Settings" menu.

Select "Payment Limits" to view your current sending and receiving caps.

Understanding your limits allows you to plan your transactions and avoid declined payments.

How Much Can You Send on Venmo for Free?

If you’re wondering, "How much can you send on Venmo for free?" the answer depends on your account’s verification status. Payments between Venmo users do not incur fees, provided you use your Venmo balance, linked bank account, or debit card. However, using a credit card attracts a 3% fee.

To maximize free transactions, ensure your account is verified and avoid exceeding the weekly cap.

Venmo Send Limit per Day

Although Venmo does not enforce a daily sending limit, your transactions count toward the weekly limit. For example, if you send $2,000 in a single day, only $2,999.99 will remain for the rest of the rolling week. Monitor your transactions to stay within the weekly limit.

How to Increase Your Venmo Weekly Limit

If your current limits are insufficient, you might ask, "How can I get a Venmo weekly limit increase?" The best way to do this is by verifying your account. Here’s how:

Go to the "Settings" section in the Venmo app.

Provide the requested personal details, such as your Social Security Number (SSN).

Follow the prompts to complete the verification process.

Once verified, your weekly limit will increase significantly, allowing for larger transactions.

Venmo Weekly Limit and Taxes

When managing your Venmo transfer limit tax obligations, it’s important to note that transactions exceeding $600 in a calendar year may require reporting to the IRS. Venmo provides users with 1099 forms for eligible accounts, making it easier to stay compliant.

Insights from the Community: Venmo Weekly Limit Reddit Discussions

Reddit often provides valuable user insights on navigating Venmo’s limitations. Many users share tips for optimizing their Venmo weekly limit Reddit experiences, such as timing transactions to align with the rolling limit reset and utilizing alternative payment methods for larger amounts.

Tips for Managing Your Venmo Weekly Limit

1. Plan Your Transactions

Divide your payments strategically to avoid hitting your limit prematurely. Keep a close eye on your spending to ensure you stay within the cap.

2. Verify Your Account

As mentioned earlier, verifying your account unlocks higher limits, making it easier to manage larger transactions without disruptions.

3. Track Your Rolling Limit

Since the limit resets on a rolling basis, keep track of when previous transactions drop off to maximize your available funds.

4. Consider Alternative Platforms

For larger payments exceeding Venmo’s limits, consider using bank transfers or other payment services to supplement your transactions.

Conclusion

Understanding and managing the Venmo weekly sending limit is crucial for seamless financial transactions. By verifying your account, planning your payments, and staying informed about your current limits, you can make the most out of this convenient platform.

1 note

·

View note

Text

How to Verify Your Account to Increase Venmo Weekly Sending Limit

Are you looking to increase your Venmo weekly sending limit? Verifying your account is the key to unlocking higher limits. In this guide, we will walk you through the steps to verify your Venmo account and increase your Venmo limit.

Step-by-Step Guide to Increase Your Venmo Weekly Sending Limit

Increasing your Venmo weekly sending limit involves a few straightforward steps. Here’s a step-by-step guide to help you through the process:

Step 1: Open the Venmo App

Launch the Venmo app on your mobile device.

Log in to your account if you haven’t already.

Step 2: Access the Menu

Tap the three horizontal lines (menu icon) in the top-left corner of the screen.

Select "Settings" from the menu options.

Step 3: Navigate to Identity Verification

In the "Settings" menu, tap on "Identity Verification."

You will be directed to the verification process, which is essential to increase your Venmo limit.

Step 4: Provide Personal Information

Enter your legal first and last name.

Provide your date of birth.

Enter your Social Security Number (SSN). You may only need to enter the last four digits in some cases.

Step 5: Submit Additional Documentation (if required)

Venmo may ask for additional documentation to verify your identity, such as a government-issued ID.

Follow the on-screen instructions to upload the required documents.

Step 6: Complete the Verification Process

Review all the entered information for accuracy.

Submit the verification form.

Venmo will review your submission and notify you once your account has been verified.

Benefits of Increasing Your Venmo Limit

Verifying your account and increasing your Venmo limit allows you to enjoy several benefits:

Higher Sending Limits: Once verified, your Venmo weekly sending limit will increase significantly, enabling you to send more money.

Enhanced Security: Verification adds an extra layer of security to your Venmo account, protecting your transactions.

Access to Additional Features: Some features and services within Venmo are only available to verified users.

Conclusion

Increasing your Venmo weekly sending limit is a straightforward process that involves verifying your account. By following the steps outlined above, you can easily complete the verification process and enjoy the benefits of higher sending limits on Venmo. Remember, verifying your account not only increases your Venmo limit but also enhances the security of your transactions.

FAQs

Q1: How long does it take to verify my Venmo account?

A1: The verification process typically takes a few minutes to a few business days, depending on the additional documentation required.

Q2: Why is Venmo asking for my SSN?

A2: Venmo requires your SSN to comply with federal regulations and to verify your identity.

Q3: What is the new weekly sending limit after verification?

A3: After verifying your account, your Venmo weekly sending limit increases to $6,999.99.

Q4: Can I use Venmo without verifying my identity?

A4: Yes, but your sending limit will be significantly lower, and you won’t have access to certain features.

Q5: Is my personal information secure with Venmo?

A5: Yes, Venmo uses encryption and other security measures to protect your personal information.

By following these steps and tips, you can increase your Venmo weekly sending limit and make the most out of your Venmo account.

0 notes

Text

Is your wallet $0:00 I will help you get $5,000 in 24hrs but you will give me 10% commission after receiving the pay Dm me how.

#across the spiderverse#free gif pack#paypal#venmo#cash app bitcoin weekly limit#anything helps#cash app limit#cash app bitcoin purchase limit#cash app bitcoin verification

1 note

·

View note

Text

The Week Ahead: August 26 - September 1, 2024

We’re in a waning Moon this week. This is not a good time to start anything, but it’s very supportive if you want to stop doing something. (Quitting a bad habit, for example.) While the Moon is in Cancer, it’s a good time to prune things that you want to grow back slowly (like a high-maintenance hairdo?); when it’s in Gemini and Leo, it’s a good time to weed (or get rid of unwanted body hair).

Lunar Phases

Monday, August 26, 09:26 UT - Last Quarter Moon, 3°38’ Gemini

The key phrases for the Last Quarter lunar phase are “turn away,” and “tear down old structures that no longer serve us well.” One way to determine what to do, is to look at what we have lost interest in. What bores us? What do we have a hard time focusing on? What are we using as a distraction? We’re probably mentally sluggish (Mercury rules Gemini, and is stationary), so we’ll be patient trying to sort through our thoughts.

Friday, August 30, 02:17 UT - Balsamic Moon, 22°12’ Cancer

The key phrases for the Balsamic lunar phase are “let go of the past,” and “envision the future.” This is a holiday weekend in the US, and if you have the extra time off, take the opportunity to nurture yourself. Even if you have to work*, you can still make sure you eat comfort food, hydrate, and rest.

* Ms M remembers long ago, when everybody had Labor Day off. We’d all remind ourselves to fill up our cars beforehand, as the gas stations wouldn’t be open on Labor Day. Sigh.

Void of Course Moon

Monday, August 26, 01:40 UT (Taurus) - 03:04 UT (Gemini)

Wednesday, August 28, 07:14 UT (Gemini) - 08:47 UT (Cancer)

Friday, August 30, 15:24 UT (Cancer) - 17:09 UT (Leo)

Monday, September 2, 00:25 UT (Leo) - 03:48 UT (Virgo)

Retrograde/Direct/Etc.

Pre-retrograde shadow: Jupiter/Gemini

Retrograde: Mercury/Leo (until Wednesday the 28th), Ceres/Capricorn (until Monday the 26th), Saturn/Pisces, Chiron/Aries, Uranus/Taurus (starting Sunday the 1st), Neptune/Pisces, Pluto/Aquarius-Capricorn, Eris/Aries

Post-retrograde shadow: Mercury/Leo (starting Wednesday the 28th), Ceres/Capricorn (starting Monday the 26th), Pallas/Scorpio

Transiting Ceres stations direct on Monday, August 26, 07:38 UT, at 7°29’ Capricorn. As she re-retraces her steps in this sign, between now and November 11, we can implement structured plans, with more of an eye on the longer-term. October 10-17 should be an especially productive time.

Transiting Mercury stations direct on Wednesday, August 28, 21:14 UT, at 21°24’ Leo. We aren’t out of the “Storm” until September 3, though, so continue to be cautious!

Transiting Uranus stations retrograde on Sunday, September 1, 15:18 UT, at 27°15’ Taurus. Those parts of our lives that feel stuck in a rut (even if it’s a comfortable rut), are “encouraged” to change, Uranus-style. Look for sudden surprises and disruptions. Uranus stations direct on January 30, 2025, at 23°15’ Taurus.

Ingresses

Thursday, August 29, 13:23 UT - transiting Venus enters Libra

Lasting until Sept. 23, we need to work hard on being more Eleanor Roosevelt and less Lady MacBeth. We want connection, and we need to be honest and reciprocal about acquiring it.

Monday, September 2, 00:10 UT - transiting Pluto retrogrades into Capricorn

One final visit, until November 19. A final chance to work on choosing integrity and responsibility - as opposed to being a status-driven control freak.

Et Cetera

There is one Opportunity Period this week: Wednesday, August 28, 08:47 UT - Friday, August 30, 17:09 UT. “Very good opportunity to implement changes and return to projects that were stuck during Mercury’s retrograde period.” (The next OP happens on Monday, September 9, so if you work with these be prepared!)

Format change - due to health concerns, this week I’m going to cut back on writing posts. Hence I went into more detail with this forecast! After this week, I will probably continue with a “beefed up” weekly and limit other posts to lunar phases.

______________________

Venmo Mary_Brack

PayPal MaryVBrack

Thank you!

22 notes

·

View notes

Text

NEW COMMISSION INFO!

I've updated my commission templates to be more readable and professional! Click for better quality. Transcript below the cut.

Help me save up to adopt a dachshund! As many of you know, I've been applying for doxies nonstop for a while now. Hopefully one will come through soon! Commission funds will go towards adoption fees, vet bills, food, meds, toys, and more!

I'll be posting weekly updates using this adorable weiner meter in the pinned post on my profile. Also- pictures of the dog once I get them!!

Please reach out if you have any questions! There's no dumb questions. If you want something that's not listed above, we can chat about it and I'll make you a custom price.

Thank you in advance!! Shares appreciated <3

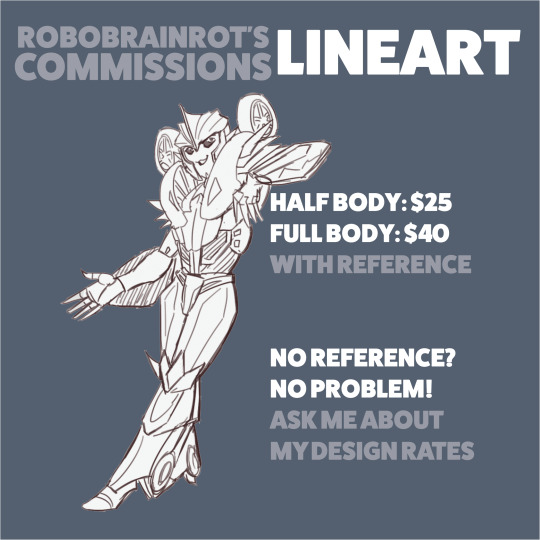

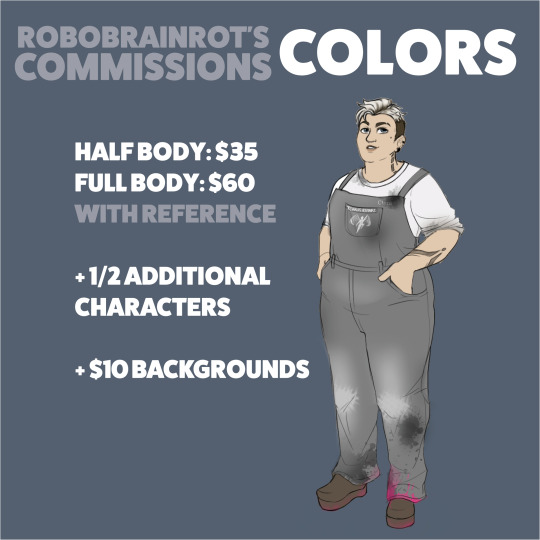

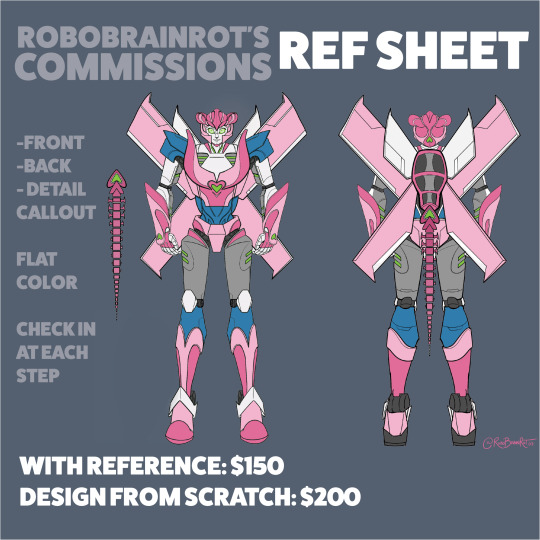

Robobrainrot commissions condensed.

LINE ART

Half body: 25, Full Body: 40

FLAT COLORS

Half body: 35, Full Body: 60

RENDER

Half body: 60, Full Body: 100

SELF INSERT PAIRS

Line art only; Half body: 25, Full Body: 40

Flat color; Half body: 50, Full Body: 75

REFERENCE SHEET

(Front view, back view, detail call out. Flat color. Design check ins at each step with space for review/edits)

With visual reference: 150

Design from scratch: 200

CHIBIS

Flat color: 25, Shaded: 35

The Rules

All commissions are for personal use only

Payment upfront through kofi venmo or paypal

Will draw: fandom, fan characters, original characters, humanoids, mecha, anthro/furries

Won't draw: graphic NSFW (suggestive okay, handled on a case by case basis), hateful art, art for commercial use including but not limited to NFTs, merch, and monetized streams.

~I have the right to refuse any commission that violates my rules or if I feel uncomfortable with it. I am a person, I have my limits~

By commissioning me, you agree to these terms.

#commissions#commission update#the epic weiner saga#weiner update#transformers#maccadam#mecha commissions#oc commissions#fan commissions#commissions open#artist support#furry commissions#anthro commissions#self insert#self insert commissions#si community#freaks of tumblr please interact <3#robobrainrot commissions#robobrainrot art

43 notes

·

View notes

Text

What is the maximum money that can be sent via Zelle?

What is the maximum money that can be sent via Zelle?

Zelle has managed to become one of the new alternatives to sending and receiving money in the United States. It has gained users as an easy-to-use application that helps customers facilitate transfers regardless of the bank to which users belong.

One of the characteristics of Zelle is the immediacy that characterizes this new service because, in a matter of minutes, transfers are made regardless of where they are.

One of the most common questions from Zelle customers in the United States is about the maximum limit that can be sent in a transfer daily, weekly or even monthly.

We will clarify the general aspects of the limits established by Zelle for the money transfers depending on the financial institution to which you belong and the limits established by the banks themselves.

What is the limit of money that can be sent by Zelle in the United States?

If your bank does not yet offer the Zelle service, the weekly allowable limit is $500, which cannot be increased or decreased regardless of conditions.

However, if your bank offers the Zelle service, the sending limits are established specifically by each financial institution, which we detail below.

Wells Fargo, Bank of America

These two institutions tell us that the daily limit to send money through Zelle is $3,500, although if you usually send money monthly, the maximum you can transfer will be $20,000.

Capital One, CitiBank, and US Bank

In these three banks, the figures vary, and their daily limit is lower than that offered by other institutions, although higher than that offered by Zelle to customers who do not yet have the service. The daily maximum varies between $1,500 to $2,500, depending on the client’s account type.

Finally, other banks like TD Bank have daily minimums of $1,000 and monthly maximums of $10,000.

Zelle Limits at Top Banks: Daily and Monthly

Mobile payment tools make it faster and more convenient for you to send and receive money for personal, professional or small business purposes. Along with PayPal, Cash App and Venmo, Zelle is a platform that allows you to send money from your bank account to an intended recipient with no fees attached.

Here’s a closer look at how Zelle works, its limits at many of the country’s top banks and what you can do if you reach these monthly and daily limits.

More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today.

What Are Zelle Limits at National Banks?

Banks often have different limits on how much users can receive or send. The following table lists the daily and monthly Zelle limits at some of the country’s largest banks.

What Are Some Alternative Options if You Hit Your Zelle Limit?

There are other ways to send money if you hit the Zelle limits. Here are some alternatives to consider.

Try another payment platform: Some popular payment platforms include Venmo, PayPal and Square. Many of these services charge a small fee to send money, and users need an account to receive the money.

Write a personal check: While personal checks may seem outdated, they are an excellent alternative to peer-to-peer transfer apps if you need to send a large sum of money.

Withdraw cash: People typically do not have a lot of cash on hand because of the popularity of debit cards, but you can always make a trip to the ATM to withdraw some money.

Use a payment retailer: Western Union and MoneyGram allow you to send money by visiting an authorized retailer and funding the transaction with cash or a debit card. Your recipients can pick up the money by visiting a retailer and providing their name and the transaction number.

Wait a few days: Waiting 24 hours or 30 days until you are back under Zelle’s payment limits is the slowest strategy, but it may be necessary if you want to send a large payment.

How Does Zelle Work?

Here are the steps for sending or receiving money through Zelle.

Step 1: Choose your recipient. Due to increasing Zelle fraud, you should only send money to people you know and trust, like repaying a family member or friend or paying a service provider.

Step 2: Obtain the recipient’s phone number or email address. Anyone with an account at a U.S. financial institution can receive money through Zelle with their phone number or email.

Step 3: Decide your payment amount. Your Zelle limit depends on your bank or credit union. If you want to send a large amount consistently, you may need to find an alternative payment option.

Step 4: Send the money. Your recipient will typically receive the money in minutes if they are already a member of Zelle. They’ll receive instructions on obtaining the funds via email or text if they are not enrolled.

Step 5: Verify the payment. You should always follow up, contacting the recipient to make sure they received the money. You should also check your bank account to ensure it deducted the proper amount from your account.

What Are the Benefits of Using Zelle?

One of the biggest benefits of using Zelle is that it is free and there are no fees to send or receive money. Most competitors charge a small fee if you use a Visa, Mastercard, debit card or credit card to send money, while others charge to transfer funds received to a bank account. Zelle can offer the service at no cost to customers because money is sent directly between bank accounts with no middleman.

While there’s no cost to use Zelle, you can only use your checking, savings or debit card to send or receive money, and you can’t make credit card payments. To be sure, you should check with your bank or credit union to make sure it doesn’t charge extra fees for using the Zelle feature.

An additional benefit of using Zelle over another payment application is the instant nature of the service. The money is immediately transferred to your recipient’s bank account because there’s no intermediary. It takes a few days to transfer funds from the app to a bank account with other services. Other platforms that do offer instant transfers charge a fee for the service.

Final Take To GO

Your bank must have a partnership with Zelle for you to access its features. More than 1,000 financial institutions in the U.S. offer Zelle to their customers. Financial institutions typically incorporate Zelle’s capabilities into their mobile banking apps.

If your financial institution offers Zelle, you should contact it directly to inquire about its daily and monthly sending limits. If your bank or credit union does not provide the service, you must download the Zelle app to send and receive payments.

FAQ

Can I get paid with Zelle?

While Zelle is a popular way to send money, it's also an easy way to receive money from individuals, companies, government agencies and even academic institutions. For instance, it may be possible to request payment via Zelle if you are owed a refund from a university or government agency. Sending money through Zelle is free for both parties and quickly ensures you get the funds.

Can businesses use Zelle?

Just like PayPal, any individual or business with an account at an institution that uses Zelle can use the feature to send or receive money. Many business owners use the service to send and receive money because there are no fees involved. You may want to encourage your customers to send payments via Zelle if the amount is within their daily Zelle transfer limits. It may be necessary to accept other methods for large payments.

What is the maximum you can send with Zelle?

The maximum amount you can send through Zelle depends on what bank you use as the cap will vary both daily and monthly by each financial institution. For example, Bank of America and Wells Fargo have a maximum daily limit of $3,500 whereas TD Bank has a daily limit of $2,500.

Can you send $5,000 through Zelle?

Yes, you can send $5,000 through Zelle if you have a private client or business checking account with Chase.

Can you send $10,000 through Zelle?

The amount you are able to send through Zelle depends on your bank's set limits. Many banks allow you to send $10,000 in a month, but not in one day. Check with your financial institution to find out your daily and monthly sending limits.

How do I increase my Zelle limit?

There is no way to increase your Zelle limit. If you find their limits to be too confining for your needs, you can try another payment platform such as Venmo or PayPal.

#limit zelle#zelle transfer limit#zelle limits#zelle daily limit#zelle limit per day#bank of america zelle limit#zelle maximum transfer#chase zelle limits#zelle weekly limit#zelle transfer limit bank of america#zelle sending limit#zelle transaction limit#zelle limits bank of america#zelle transfer limit 2023#maximum zelle transfer#zelle daily transfer limit#zelle daily limit bank of america#usaa zelle limit#zelle account limit email#zelle monthly limit#zelle payment limits#zelle business account limits#zelle limits chase#zelle maximum amount

2 notes

·

View notes

Text

How to Transfer Money from Cash App to Bank Account: A Complete Guide

Cash App is a popular peer-to-peer payment service that allows users to send, receive, and withdraw money conveniently. Whether you need to cash out to your bank, debit card, or even another payment service like PayPal or Venmo, understanding how to do it efficiently is essential.

In this guide, we’ll cover everything you need to know about transferring money from Cash App to your bank account, including fees, processing times, and potential issues.

1. How to Cash Out on the Cash App

Cashing out on Cash App simply means withdrawing your available balance to your bank account or debit card.

Steps to Cash Out:

Open the Cash App on your phone.

Tap on the Banking Tab (🏦 icon).

Select "Cash Out."

Enter the amount you want to withdraw.

Choose between Standard Deposit (1-3 business days) or Instant Deposit (within minutes, with a fee).

Confirm the transfer and wait for the funds to appear.

2. How to Send Money from Cash App to Bank Account

Transferring funds from Cash App to your bank account is simple and can be done manually or automatically.

Manual Transfer:

Go to the Banking Tab and select Cash Out.

Enter the amount to transfer.

Choose Standard or Instant Transfer.

Select your linked bank account and confirm the transfer.

Enable Automatic Bank Transfers:

Open Cash App.

Go to Settings > Deposits & Transfers.

Enable Auto Cash Out.

Choose between Daily, Weekly, or Monthly transfers.

3. How to Transfer Money from Cash App to Debit Card

Transferring money to a linked debit card is similar to a bank transfer, but it is faster.

Instant Deposit: Money is sent immediately, but a 1.5% fee applies.

Standard Deposit: Free, but takes 1-3 business days.

Steps to Transfer:

Tap Banking Tab > Cash Out.

Enter the amount.

Choose your debit card as the destination.

Select Instant or Standard Transfer and confirm.

4. Can You Send Money from Cash App to PayPal?

Cash App doesn’t have a direct PayPal transfer option, but you can use these methods:

Workaround Methods:

Transfer to Your Bank Account – Send funds from Cash App to your bank, then move them to PayPal.

Use a PayPal Cash Card – Add the PayPal Cash Card to Cash App and withdraw funds.

5. Can You Send Money from Cash App to Zelle?

Cash App and Zelle are not directly compatible.

Alternative Methods:

Withdraw to Your Bank – Move funds from Cash App to your bank, then send money using Zelle.

Use a Linked Debit Card – If your Zelle account is linked to the same debit card as Cash App, you can transfer funds between the two.

6. Can You Send Money from Cash App to Venmo?

Cash App and Venmo are separate platforms, but you can transfer money between them indirectly.

How to Do It:

Transfer to a Bank – Move funds from Cash App to your bank, then transfer to Venmo.

Use a Venmo Debit Card – Link the Venmo Card to Cash App and withdraw funds.

7. How to Send Money from Cash App to Apple Pay

Cash App allows users to send money to Apple Pay through a linked card.

Steps to Transfer:

Open Cash App.

Tap Cash Card > Add to Apple Pay.

Follow the on-screen instructions to link the card.

Use Apple Pay to make purchases with your Cash App balance.

FAQs

1. How long does it take to transfer money from Cash App to a bank?

Standard deposits take 1-3 business days.

Instant deposits happen within minutes (with a 1.5% fee).

2. What is the Cash App withdrawal limit?

Standard accounts can withdraw up to $1,000 in 30 days.

Verified accounts can increase limits to $7,500 per week.

3. Can I cancel a Cash App transfer?

No, once a transfer is initiated, it cannot be canceled.

4. What should I do if my Cash App transfer fails?

Ensure you have enough funds.

Check your internet connection.

Contact Cash App Support if the issue persists.

5. Does Cash App charge fees for bank transfers?

Standard deposits are free.

Instant deposits charge a 1.5% fee.

6. Can I use Cash App internationally?

No, Cash App is only available in the U.S. and U.K..

Conclusion

Transferring money from Cash App to your bank, debit card, or other services like PayPal and Venmo is easy if you follow the right steps. Whether you choose a standard or instant deposit, understanding the fees and limits will help you manage your funds efficiently.

0 notes

Text

What to Do When Your Cash App Withdrawal Limit Is Too Low: How to Increase It

In today’s fast-paced digital world, Cash App has become one of the leading mobile payment platforms, allowing users to send money, buy Bitcoin, pay bills, and even withdraw funds from ATMs — all from the convenience of their smartphones. However, as with most financial tools, Cash App imposes withdrawal limits to ensure safety and compliance with financial regulations.

For many users, these Cash App withdrawal limits can sometimes feel restrictive, especially when it comes to large transactions or frequent ATM withdrawals. Whether you need to access more cash from your Cash App ATM or send a larger amount, understanding how the Cash App withdrawal limit works — and how to increase it — is key to making the most of your Cash App account.

What is the Cash App Withdrawal Limit?

The Cash App withdrawal limit refers to the maximum amount of money you can withdraw from Cash App accounts or ATMs within a specific period, typically daily or weekly. Cash App has different withdrawal limits based on account verification, which means unverified accounts are subject to lower limits compared to verified accounts.

In simple terms, Cash App withdrawal limits are designed to protect users against fraud, ensure compliance with regulatory standards, and mitigate risks. These limits can be broken down into daily and weekly categories for both ATM withdrawals and peer-to-peer (P2P) transactions.

1. Cash App ATM Withdrawal Limit

The Cash App ATM withdrawal limit is the amount you can withdraw from an ATM using your Cash App card. For unverified users, this limit is $250 per day. Once your account is verified, your Cash App ATM withdrawal limit increases to $1,000 per day. Additionally, there’s a weekly withdrawal limit of $1,250.

It’s important to note that Cash App also charges a $2 fee for each ATM withdrawal, in addition to any fees charged by the ATM operator.

2. Cash App Withdrawal Limit for Sending Money

For peer-to-peer transactions, the Cash App withdrawal limit per day refers to the maximum amount you can send or receive through the app. Unverified accounts can send up to $250 per week and receive up to $1,000 per month. However, after completing the account verification process, the Cash App withdrawal limit per day for sending money increases to $7,500 per day. Similarly, you can send up to $17,500 per month once your account is fully verified.

How to Increase Your Cash App Withdrawal Limit?

While Cash App withdrawal limits can feel restrictive, they are not set in stone. There are several ways you can increase your Cash App withdrawal limit, particularly when it comes to ATM withdrawals and sending money.

1. Verify Your Cash App Account

The most straightforward way to increase your Cash App withdrawal limit is by verifying your account. Account verification requires you to submit some personal details to Cash App, including

Full Name

Date of Birth

Social Security Number (SSN)

A photo of your government-issued ID (e.g., driver’s license or passport)

Once you complete the verification process, your Cash App ATM withdrawal limit increases to $1,000 per day, and your daily sending limit jumps to $7,500. Verification typically takes just a few minutes, although Cash App may take longer depending on the volume of users and the accuracy of your information.

Cash App Withdrawal Limits vs. Other Platforms

When compared to other mobile payment services like PayPal, Venmo, or Zelle, Cash App’s withdrawal limits are relatively competitive. While these services often impose similar restrictions, Cash App offers a higher ATM withdrawal limit for verified users, with up to $1,000 per day. However, users should still be aware of potential fees and delays when withdrawing large amounts.

FAQs About Cash App Withdrawal Limits

1. What is the Cash App ATM withdrawal limit?

For verified accounts, the Cash App ATM limit is $1,000 per day and $1,250 per week. For unverified accounts, the limit is $250 per day.

2. How can I increase my Cash App withdrawal limit?

To increase Cash App withdrawal limit, you need to complete the verification process by submitting your personal details and a government-issued ID. This will raise your limits significantly.

3. What is the Cash App withdrawal limit per day for sending money?

For verified accounts, the Cash App withdrawal limit per day for sending money is $7,500. For unverified accounts, this limit is much lower at $250 per week.

4. Does Cash App charge fees for ATM withdrawals?

Yes, Cash App charges a $2 fee for each ATM withdrawal. Additionally, ATM operators may charge their own fees, which can vary.

6. Can I increase my Cash App withdrawal limit without verifying my account?

No, the only way to increase your Cash App withdrawal limit beyond the standard unverified limits is by completing the account verification process.

0 notes

Text

What Is the Most Money You Can Send on Venmo Without Verification?

Are you wondering what is the most money you can send on Venmo? Whether you are planning to send money for a large purchase, pay for a vacation, or help a friend in need, it is essential to understand the Venmo sending limit and how it works to avoid any surprises. Although Venmo is renowned for its fast and simple payments, they have a few limitations to be aware of before making use of it.

Additionally, Venmo transfers have different limits based on the status of your account. If you are not verified it is possible to transfer the most amount per week is able to transfer per week using Venmo with no verification can be $300. If your account is verified however, it is increased to $7,000. While verification procedures can require time and patience, they offer greater flexibility and security in your transactions.

What Is the Most Money You Can Send on Venmo Without Verification?

Venmo puts restrictions on accounts that are not verified to ensure integrity and security in transactions. Without verifying your identity, you are restricted to the amount you can transfer, receive or withdrawal. Here is what you should know about

Venmo Sending Limit Without Verification

Limit on weekly sending: If you do not verify the Venmo limit on sending is $299.99 per week.

Monthly limit on sending: There is not any monthly limit that you can set without a confirmation, however the weekly cap remains in effect. This can restrict the ability to send greater sums over a period.

Why Should You Verify Your Venmo Account?

Verifying the account will provide you a safer and more convenient experience using Venmo. Once you have completed the verification procedure your limits are increased which will give you more freedom regarding the amount you can pay, send, or withdraw.

What Is the Most Money You Can Send on Venmo to Bank Account?

Transferring funds out of the Venmo account balance into your bank account linked is a must-have feature for a lot of customers.

Venmo Bank Transfer Limits

Standard Bank Transfer: With a verified bank account, the maximum you can transfer to the connected bank account $19,999.99 per week.

Instant Transfer to Bank: Venmo allows instant transfers to debit cards, however there is a limit of limit of $500 per transaction and you can perform up to 30 instant transfers per day.

What Is the Most Money You Can Send on Venmo for Free?

Venmo allows free transfers with certain conditions. However, when you wish to transfer massive amounts of money with no need for fees there are limits depending on the kind of transfer you are making:

Venmo's Free Payment Limits

Sending money to family and friends It is possible to transfer money to your family and friends for no cost provided you use a linked banking account, or Venmo balance as your source of funding. Credit cards as well as debit cards and instant transfers can incur charges however sending money using the Venmo balance or bank account linked to it does not.

Transfer to bank: Venmo allows you to transfer money directly to your bank accounts for free without charges using the traditional procedure of transferring. However, immediate transfers can cost an additional cost.

How Do I Know My Venmo Limit?

You can check the Venmo limits by taking the steps mentioned below:

Open the Venmo application on your smartphone.

Click the (Menu) located in the upper right corner.

Go to Settings > Payment Methods.

Click on Limits for a look at your current Venmo limit on sending Limits on transfers, monthly and weekly limits.

In case you have not checked your account's authenticity, you might be presented with a prompt explaining the limits of your account and how you can verify your account to raise the amount.

How to Increase Your Venmo Limit?

If you wish to increase Venmo limit for sending the first step is to confirm that your account is verified. Venmo's verification process involves verifying your identity. This can be completed in the app in three steps:

Steps to Verify Your Venmo Account:

Start your Venmo app and then tap the Menu icon in the upper left-hand corner.

Select Settings > Identity Verification.

Input the necessary personal details, like:

Full name.

Birth date.

Social Security Number (SSN) (for U.S. users).

Upload a picture on your identity document (driver's licence or passport).

You must wait for Venmo to verify your information (usually takes between 1-2 working days).

Once you have successfully verified after successful verification, you'll be able transfer as much as $4,999.99 per day. You will also be able to enjoy more limits on paying and sending money.

What is the Venmo Limit Per Week?

For those with verified Venmo account the Venmo limit per week for sending can be set to $19,999.99 for money transfer to friends, making payments for services or goods, and for transfer transactions for linked banks. If you perform a regular bank transfer and pay for a standard bank transfer, exactly the exact $19,999.99 per week limit applies for the possibility of making 30 transfers in a every day. This applies to transactions made with debit cards.

What Is the Transfer Limit on Venmo?

Venmo lets users transfer money from their account to connected debit or bank accounts. Below mentioned are the different types of Venmo transfer limits:

Standard Transfers Maximum $19,999.99 per week is transferred to your account at a bank.

Instant Transfers up 500 dollars per transfer (with an additional fee of 1% to make instant transfer).

Limits are only applicable to authentic Venmo account holders. If your account is not verified your weekly transfer limit may be less.

Why Is Venmo Charging Me a Fee to Receive Money?

Venmo has a cost to pay cash when linked to certain payment methods, like:

Receiving payments for goods or services: Venmo charges 2.9% + $0.30 per transaction for payments that are related to business.

Receiving payments via Credit Card If someone makes use of credit card to transfer the money to you, you will pay an additional 3% charge.

FAQ

What is the maximum amount I can pay to Venmo without confirmation?

If you do not have confirmation, you can make a payment of the maximum amount of $299.99 every week.

How do you increase the Venmo limit for sending?

To increase Venmo sending limit, you need to verify you account by submitting personal details and ID proof.

What is the Venmo transfer fee?

Standard transfer transactions are completely free and Instant Transfers are charged the cost of 1. Credit card transactions are charged 3 percent fee.

Can I transfer $500 to Venmo in a flash?

It is true that you can transfer $500 through Instant Transfer. However, the fee is 1.

How much is Venmo daily transfer limit?

The Venmo daily limit for transfers to verified customers can be $4,999.99.

How to send money through Venmo?

How can I send a payment or request money with Venmo?

Tap Pay/Request at the bottom of the screen.

Search and add the person you want to pay or charge.

Enter an amount and add a note.

Tap Request or Pay.

0 notes

Text

Navigating Cash App's ATM Withdrawal Limits: What You Need to Know

Cash App has revolutionized the way we handle money, offering a blend of convenience and control right at your fingertips. However, like any financial service, it comes with certain limitations, especially when it comes to withdrawing money from Cash App ATMs. Understanding these limits, why they exist, and how you can manage them is crucial for optimizing your Cash App experience.

Understanding Cash App's ATM Withdrawal Limits

Cash App provides a simple and secure way to access your funds. The Cash App daily ATM withdrawal limit is typically set at $310 per transaction, $1,000 in any 24-hour period, and $1,000 in any 7-day period. These limits are designed to protect both the user and the service from fraud and excessive losses.

Comparing Cash App with Other Digital Wallets

When stacked against competitors like Venmo or PayPal, Cash App's ATM withdrawal limits are fairly comparable. Each service has its unique set of rules and limits, shaped by their specific security measures and customer needs. For example, Venmo has a similar weekly withdrawal limit but allows for slightly higher amounts per transaction.

Reasons behind Cash App ATM Withdrawal Limits

The primary reason for setting ATM Cash App withdrawal limits is security. Limiting the amount of money that can be withdrawn in a single transaction or within a short period reduces the risk of financial loss due to theft or unauthorized access. It's a balancing act between user convenience and protective measures.

Increasing Your Cash App ATM Withdrawal Limit

Increasing your limit with Cash App involves verifying your identity with the platform. This process includes providing your full name, date of birth, and the last four digits of your social security number. Once verified, you may request an increase, though it's subject to review and not guaranteed.

Tips for Managing Within Your Cash App ATM Limit

Managing your funds within these limits requires a bit of foresight and planning. For instance, if you know you'll need more cash for an upcoming event, plan your withdrawals ahead of time to avoid hitting your limit unexpectedly.

FAQs

What is the daily ATM withdrawal limit for Cash App?

The daily limit for ATM withdrawals with Cash App is $310 per transaction, up to $1,000 per 24 hours, and $1,000 per 7 days.

Can I increase my ATM withdrawal limit on Cash App?

Yes, you can request an increase in your Cash App ATM withdrawal limits by verifying your identity and submitting a request through the app.

Are there fees associated with Cash App ATM withdrawals?

Yes, Cash App charges a $2 fee for ATM withdrawals, which is in addition to any fees that the ATM owner might charge.

What should I do if I reach my ATM withdrawal limit?

If you reach your Cash App limit, you'll need to wait until some of your previous withdrawals fall outside of the current limit window (24 hours or 7 days) before you can withdraw more funds.

How does Cash App's ATM limit compare to traditional bank limits?

Cash App's limits are generally lower than those of traditional banks, which can offer higher daily and weekly limits depending on the account type and customer standing.

Conclusion

Navigating the ATM withdrawal limits on Cash App doesn't have to be a hurdle. By understanding and planning according to these limits, you can make the most out of your Cash App experience. Remember, these limits are there to protect you and can often be adjusted with proper verification and account standing. Plan ahead and stay informed to keep your financial journey smooth and secure.

1 note

·

View note

Text

What Happens When You Exceed Venmo Personal Account Limits?

Venmo has become synonymous with fast peer-to-peer money transfers that are both simple and social, drawing millions of users daily. Understanding its limits of functionality is vital for getting the most from using this app; these limits vary based on verification status as well as transaction type (Venmo has a daily limit of $3,000 when sending or receiving funds via its app - however this does not apply when reloading from bank directly). With frequent use comes risk: of quicky reaching the Venmo send money limit. So, what to do in such as situation.

How do you increase the Venmo daily max limits? Venmo comes with its own set of rules that you should abide by if you want to maximize its use, with increasing limits by verifying your account in the app. Verification allows Venmo users to increase limits more easily!

What are the different types of Venmo Personal Account Limits?

Venmo users must abide by certain limits to ensure a secure transaction environment, which includes sending, receiving, and withdrawing money. These categories of limits can be broken down further into sending, receiving, and withdrawing categories. Below mentioned are the different types of Venmo personal account limits:

Venmo Daily Send Limit: If your account has not been verified yet, Venmo will cap weekly transactions at $299.99; both payments and purchases count towards this total. Your weekly limit can increase up to $6,999.99 once you provide information such as your Social Security Number, legal name, and date of birth.

Venmo Weekly Sending Limit: For verified accounts, this limit of $6,999.99 per week covers all transactions including payments to friends or purchases made from authorized merchants.

Venmo Weekly Limit: You are limited to making transfers of up to $19.999.99 every week between Venmo and bank accounts; individual transfers cannot exceed $2,999.99 each time.

Venmo Daily Max Limit: Debit Card Transactions: If you own a Venmo debit card, your daily limit for debit card transactions is $6.999.99 per day; this includes both online and in-store purchases.

Venmo Withdrawal Limits: Venmo ATM withdrawal limits per day can reach $400; this includes withdrawals made as cash back during purchases.

Venmo Daily Withdrawal Limit: Venmo offers non-debit card holders a daily withdrawal limit that depends on their method of transfer, while linked bank accounts have weekly limits rather than daily restrictions.

How to Increase Venmo Limits?

Verification is the key step in increasing your Venmo daily limit transfer. Once verified, follow these steps to increase the transaction limit:

Open the Venmo app on your device.

By tapping the menu icon, choose "Settings."

Follow the onscreen prompts to enter your legal name, birth date and Social Security Number before setting limits automatically once verified.

After verification, your Venmo weekly transfer limit will increase.

FAQ

What is the Venmo daily send limit for unverified accounts?

Venmo's daily transaction limit stands at $299.99 per transaction type.

How can I increase the limits on my Venmo personal account?

You can increase the limit on your Venmo personal account by verifying your account and contacting the customer support team.

What is the Venmo debit card withdrawal limit?

Venmo users can withdraw up to $400 daily using their debit cards for ATM and cash-back transactions.

Can I send $7,000 in one day on Venmo?

Only if your account has been verified. Verified accounts have an upper weekly sending limit of $6,999.99 which allows for large transactions.

What is the Venmo weekly transfer limit to a bank account?

Venmo offers weekly bank transfers of $19.999.999.99 while their single transaction maximum amount stands at $2.999.999.99.

0 notes

Text

Venmo Withdrawal Limit: Maximizing Your Financial Flexibility

In the world of digital finance and peer-to-peer payment platforms, Venmo has emerged as a leading player, revolutionizing the way we exchange money with friends and family. With its seamless interface and user-friendly features, Venmo has gained immense popularity. However, as with any financial service, there are certain limits and restrictions in place to ensure security and compliance with regulatory guidelines. In this comprehensive guide, we'll delve into the intricacies of Venmo withdrawal limits, helping you understand how to navigate them effectively to make the most of your financial transactions.

Understanding Venmo Withdrawal Limits

Venmo, owned by PayPal, offers users a convenient way to send and receive money electronically. However, to maintain financial stability and security, Venmo has established withdrawal limits for both standard and verified accounts. These limits may vary depending on several factors, including account verification status, transaction history, and other security measures.

Standard Account Limits

For users with standard Venmo accounts, which are typically unverified accounts, there are certain restrictions on how much money can be withdrawn. These limits are in place to safeguard against unauthorized use and potential fraudulent activities. As of our last update in early 2022, the standard Venmo withdrawal limits were as follows:

Daily Withdrawal Limit: Standard Venmo accounts allow users to withdraw up to $299.99 per day. This means you can transfer this amount to your linked bank account within a 24-hour period.

Weekly Withdrawal Limit: The weekly withdrawal limit for standard accounts stands at $2,999.99. This provides users with a more flexible option for larger transactions.

Verified Account Limits

To gain more financial flexibility and access higher withdrawal limits, Venmo users can opt to verify their accounts. Verification typically involves providing additional personal information and confirming your identity. As of our last update, the withdrawal limits for verified Venmo accounts were significantly higher:

Daily Withdrawal Limit: Verified accounts can withdraw up to $4,999.99 per day, offering more room for substantial financial transactions.

Weekly Withdrawal Limit: With a verified Venmo account, you can withdraw up to $19,999.99 per week, allowing for larger transfers and greater financial freedom.

Maximizing Your Venmo Withdrawal Limit

Now that you have a clear understanding of the withdrawal limits associated with Venmo, let's explore some strategies to maximize Venmo Limit and make the most of your Venmo experience.

1. Verify Your Account

The first and most crucial step to increase your withdrawal limits is to verify your Venmo account. This involves providing personal information, verifying your identity, and linking a bank account. By doing so, you not only increase your withdrawal limits but also enhance the overall security of your Venmo transactions.

2. Build a Positive Transaction History

Venmo takes into account your transaction history when determining your withdrawal limits. Consistently using Venmo for legitimate transactions, sending and receiving money with friends, and maintaining a positive track record can lead to gradual limit increases over time.

3. Link Multiple Bank Accounts

To further enhance your financial flexibility, consider linking multiple bank accounts to your Venmo profile. This allows you to diversify your withdrawal options and manage your funds more effectively. However, remember that each bank account may have its own withdrawal limits.

4. Contact Venmo Support

If you find yourself in need of higher withdrawal Venmo limits for specific reasons, don't hesitate to reach out to Venmo's customer support. They may be able to review your account and make adjustments based on your needs and circumstances.

5. Stay Informed

Venmo's policies and withdrawal limits may change over time. It's essential to stay informed about any updates or modifications to ensure you're taking full advantage of the platform's offerings. Regularly checking Venmo's official website or app for announcements can keep you up-to-date.

In Conclusion

Venmo is undoubtedly a convenient and efficient way to manage your finances and exchange money with friends and family. Understanding the Venmo Withdrawal Limit associated with your account and following the strategies outlined in this guide can help you maximize your financial flexibility on the platform. Whether you have a standard or verified account, Venmo offers a secure and user-friendly experience for all your digital payment needs.

0 notes